Chemical Engineering - Chemical Engineering Plant Economics

Exercise : Chemical Engineering Plant Economics - Section 1

- Chemical Engineering Plant Economics - Section 1

- Chemical Engineering Plant Economics - Section 2

36.

Pick out the wrong statement.

37.

Personnel working in the market research group is reponsible for the job of

38.

"Break-even point" is the point of intersection of

39.

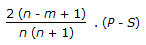

'P' is the investment made on an equipment, 'S' is its salvage value and 'n is the life of the equipment in years. The depreciation for rath year by the sum-of years digit method will be

40.

Pick out the wrong statement.

Quick links

Quantitative Aptitude

Verbal (English)

Reasoning

Programming

Interview

Placement Papers